Is Pocket Option Legal in Philippines? A Comprehensive Guide

In recent years, online trading platforms have gained considerable popularity, particularly among millennials and younger generations. One such platform is Pocket Option, which allows users to trade a variety of financial instruments. However, before diving into the world of online trading, it is essential to understand the legal framework surrounding these platforms. This article aims to explore the question: is pocket option legal in philippines is pocket option legal in philippines, and provide insights into the regulations governing online trading in the country.

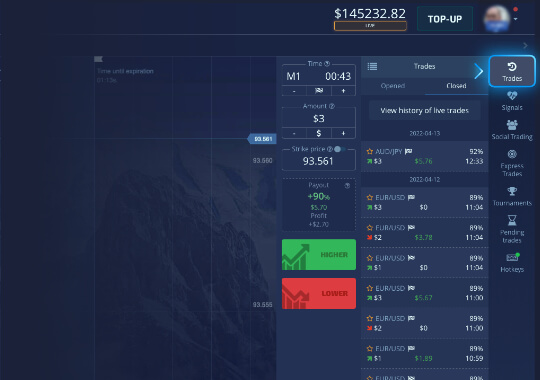

Understanding Pocket Option

Pocket Option is an online trading platform that offers its users the ability to trade various assets including currencies, cryptocurrencies, stocks, and commodities. Launched in 2017, the platform has quickly garnered a substantial user base due to its user-friendly interface and innovative features such as social trading and copy trading.

The Regulatory Landscape in the Philippines

In the Philippines, the regulation of financial markets falls under the jurisdiction of various government bodies. The primary authority overseeing online trading and other financial activities is the Securities and Exchange Commission (SEC). The SEC aims to protect investors, maintain fair and efficient markets, and facilitate capital formation.

In addition to the SEC, the Bangko Sentral ng Pilipinas (BSP) also plays a critical role in regulating financial technology firms (fintech) and maintaining the integrity of the financial system. These regulatory bodies ensure that platforms like Pocket Option adhere to local laws and regulations.

Is Pocket Option Licensed in the Philippines?

One of the key factors in determining the legality of a trading platform is whether it is licensed and regulated by the appropriate authorities. As of now, Pocket Option is not specifically licensed by the SEC or any other regulatory agency in the Philippines. This lack of local licensing raises questions about the legitimacy and safety of using the platform for trading activities.

Legal Considerations for Users

While Pocket Option operates internationally and may be accessible from the Philippines, it is crucial for users to be aware of the legal implications associated with using unregulated platforms. Trading on an unlicensed platform can expose users to a range of risks, including:

- Risk of Fraud: Without proper regulation, there is no assurance that the platform operates transparently or ethically.

- No Investor Protection: Users may have limited recourse if they encounter issues related to fund withdrawals or account management.

- Potential Legal Consequences: Engaging in trading activities on an unregulated platform may have legal ramifications, as regulations are in place to protect consumers.

Alternative Options for Filipino Traders

Given the concerns surrounding the legality of Pocket Option, Filipino traders may consider exploring regulated trading platforms that comply with local laws. Some notable options include:

- Binance: While primarily known as a cryptocurrency exchange, Binance also offers trading options for various assets. It has established a reputation for security and regulatory compliance in multiple jurisdictions.

- Investagrams: A local Filipino platform that provides a comprehensive suite of tools for trading stocks and cryptocurrencies while adhering to local regulations.

- eToro: A globally recognized social trading platform that is regulated in several jurisdictions, allowing users to trade various financial instruments securely.

Conclusion

In conclusion, the question of whether Pocket Option is legal in the Philippines remains complex. While the platform is accessible to users in the country, it is not licensed by local regulatory bodies, which may pose significant risks for traders. Individuals interested in trading online should conduct thorough research and opt for regulated platforms to ensure their investments are safeguarded.

As the regulatory environment continues to evolve, traders should stay informed about the latest developments and choose platforms that prioritize compliance and user protection. Ultimately, responsible trading begins with understanding the legal landscape and making informed decisions.