The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. There are five types of earnings per share, which are discussed further down. However, if the company instead makes 20,000 USD to pay investors, each unit of the share will then be 200 USD. Some shares are transferable, which means the shareholder can give them to another person according to company rules.

What is a Good Basic Earnings Per Share?

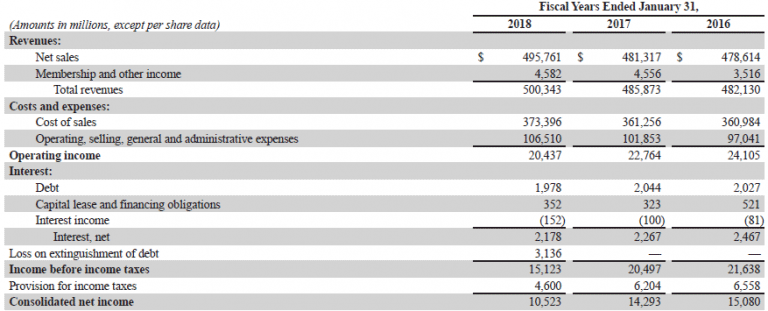

Neither the author nor editor held positions in the aforementioned investments at the time of publication. The big red rectangle shows the rows containing EPS numbers, while the smaller green rectangle shows the EPS numbers themselves. Once you find the table, you often have to dig a little more to find EPS.

- That figure uses net profit adjusted for one-time factors such as fees related to a merger, or other unusual costs.

- In this example, that could increase the EPS because the 100 closed stores were perhaps operating at a loss.

- If a company pays out $0.60 per share in dividends over the course of a year and has EPS of $0.40, it has a dividend payout ratio of 150% and will not be able to afford its dividend indefinitely.

Current EPS

Generally, if a company has dilutive securities, then the diluted EPS is going to be less than its sales tax definition. One general rule of thumb is that diluted EPS will always be lower than basic EPS if the company creates a profit because that profit has to be spread among more shares. Likewise, if a company suffers a loss, diluted EPS will always show a lower loss than basic EPS, because the loss is spread out over more shares.

How comfortable are you with investing?

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. If a firm is liquidated, the book value earnings per share are enough to calculate the worth of each share. The following are the many sorts of earnings per share that differ from the calculation described above. Though, there are specific steps the shareholder must take before converting this type of preferred share to a common one.

Calculating Diluted Earnings Per Share

Earnings per share (EPS) is an important metric that investors and analysts use to assess the profit a company generates per share of stock. If these securities are “in-the-money”, which means that these financial contracts are profitable to execute (i.e. with a monetary incentive), the total share count should factor in the net impact of these securities. In terms of our assumptions for preferred dividends, we’ll keep the amount fixed at $5mm each year. But the impact on basic EPS should be rather intuitive – i.e. increased preferred dividends causes lower EPS (and vice versa). When looking at EPS to make an investment or trading decision, be aware of some possible drawbacks.

Diluted EPS also accounts for other kinds of securities that can be converted into common shares, such as employee stock options and convertible bonds. Earnings per share (EPS) is a company’s net income divided by its outstanding shares of common stock. Net income is the income available to all shareholders after a company’s costs and expenses are accounted for. Throughout fiscal year 2021, the company issued no new shares and repurchased 20 million shares, resulting in 140 million common shares outstanding at the end of the period.

The calculation of EPS relies on net income, which includes non-cash expenses such as depreciation and amortization, which are non-cash expenses. So a company may be generating much more cash flow than its EPS numbers suggest. Over time a stock price fluctuates with expected future changes in EPS. If a company can quickly grow its EPS, then its stock will likely rise. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site.

A company with positive annual EPS is considered profitable, while a company with negative annual EPS is considered unprofitable. Earnings per share is also important to dividend investors, growth investors and speculators. NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues.